Ghana Sea, Coastal, and Inland Water Transport Industry Report 2025

Ghana’s sea, coastal, and inland water transport industry plays a critical role in the country’s economic development, trade facilitation, and regional integration. Strategically located along the Gulf of Guinea, Ghana enjoys direct access to some of the world’s busiest maritime trade routes, positioning the country as a natural gateway for both domestic commerce and transit trade serving landlocked neighbours such as Burkina Faso, Mali, and Niger. Over the past decade, Ghana has invested heavily in port modernisation, digital trade facilitation, and logistics infrastructure, resulting in steady growth in cargo volumes and vessel calls at its major ports.

The ports of Tema and Takoradi remain the backbone of Ghana’s maritime economy. Continuous infrastructure upgrades, including expanded container terminals and enhanced cargo-handling capabilities, have enabled these ports to accommodate larger vessels and rising trade volumes. The introduction of digital platforms and paperless customs clearance systems has significantly reduced cargo dwell times, improving overall efficiency. However, despite these gains, the industry faces mounting pressure from regional competitors that have invested aggressively in port infrastructure and logistics ecosystems.

At the same time, climate-related challenges such as storms, flooding, and rising sea levels are increasingly disrupting port operations and causing costly infrastructure damage. Against this backdrop, Ghana’s sea and inland water transport sector stands at a critical juncture—balancing growth opportunities with structural constraints and intensifying competition.

Overview of the Industry

Ghana’s water transport industry encompasses three interconnected segments: sea transport, coastal shipping, and inland water transport. Together, these segments support international trade, domestic distribution, energy logistics, and passenger mobility.

The industry value chain extends from port authorities, terminal operators, and shipping lines to freight forwarders, logistics service providers, inland port operators, vessel owners, ship repair yards, and regulatory agencies. Supporting sectors include fuel suppliers, technology providers, insurers, customs brokers, and workforce training institutions.

Ghana’s geographic position gives it a natural advantage as a maritime hub in West Africa. Tema Port, located near Accra, handles the majority of containerised cargo and serves as the country’s principal gateway for imports and exports. Takoradi Port, situated in the Western Region, plays a vital role in bulk cargo handling and has evolved into a key logistics base for Ghana’s offshore oil and gas industry.

Inland water transport, particularly along Lake Volta, complements maritime trade by providing a cost-effective means of moving bulk cargo and passengers between northern and southern Ghana. The Volta Lake Transport Company (VLTC), a state-owned enterprise, is central to this segment, operating vessels that link inland production zones to coastal ports.

Major Ports, Harbours, and Cargo Performance

Ghana’s two main commercial ports—Tema and Takoradi—have recorded consistent growth in cargo throughput over recent years. Tema Port’s Phase 2 expansion project has significantly boosted container-handling capacity, enabling the port to serve larger vessels and increase transshipment activity. Takoradi Port has similarly benefited from targeted investments, particularly in oil and gas logistics, bulk cargo facilities, and support infrastructure.

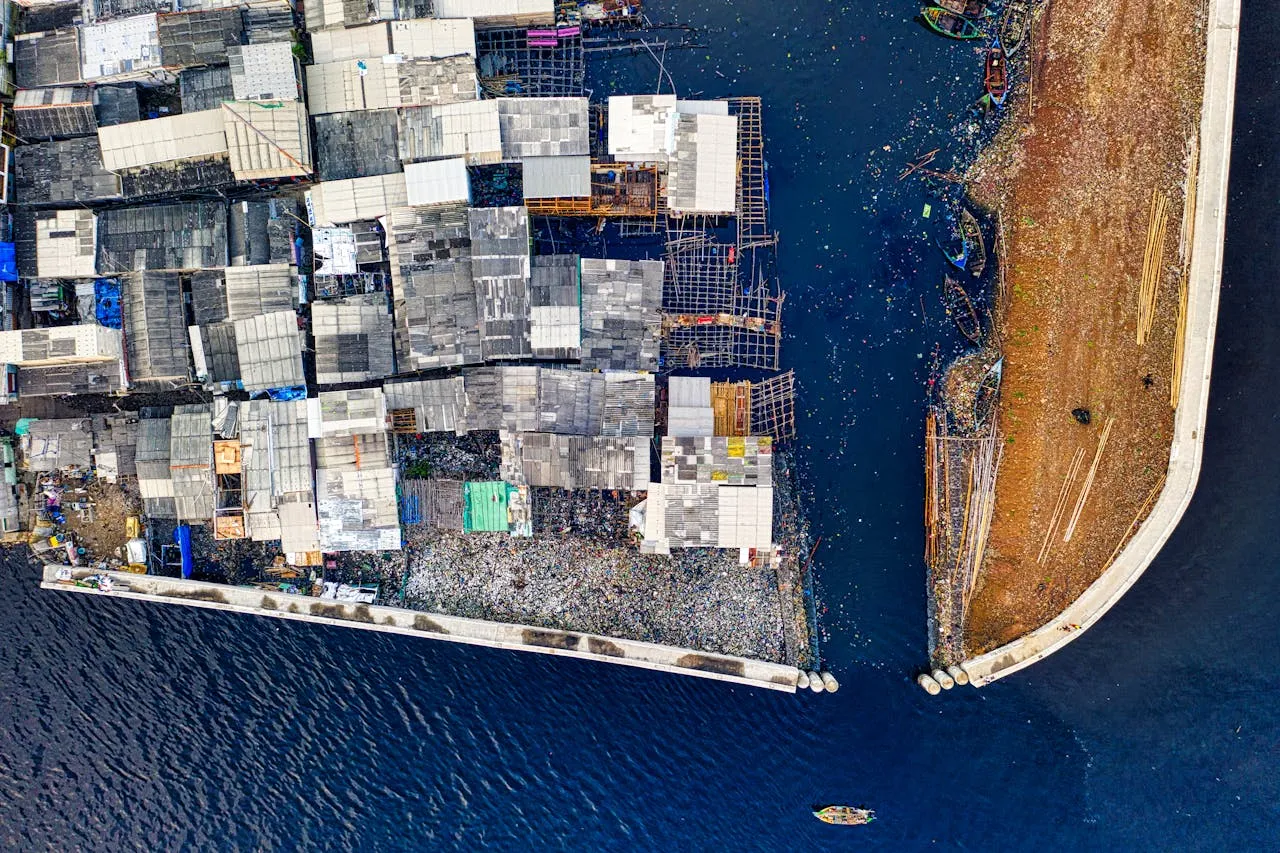

Despite these expansions, congestion remains a recurring issue, especially during peak shipping seasons. High vessel traffic, limited yard space, and procedural bottlenecks can lead to delays and increased costs for shippers. Inland ports and jetties along Lake Volta also face operational challenges linked to fluctuating water levels, debris, and limited navigational aids.

Regulatory Environment and Institutional Framework

The maritime and inland water transport sector in Ghana operates within a complex regulatory framework involving multiple institutions. Key regulators include the Ghana Maritime Authority, the Ghana Shippers Authority, and the Ghana Ports and Harbours Authority. While these agencies play essential roles in oversight, safety, and trade facilitation, overlapping mandates have resulted in fragmentation and regulatory inefficiencies.

The Ghana Shippers Authority Act has been welcomed by industry stakeholders as a step toward addressing arbitrary shipping charges and improving transparency. However, enforcement remains uneven, and high port charges, demurrage fees, and compliance costs continue to affect competitiveness.

In inland waterways, inadequate regulation has allowed unregistered and informal boat operators to operate, particularly on Lake Volta. This has contributed to safety risks, high accident rates, and reputational challenges for the sector.

Key Challenges Facing the Industry

Despite its growth potential, Ghana’s water transport industry faces several persistent challenges:

- Fragmented maritime governance, with overlapping regulatory responsibilities among key agencies

- Infrastructure constraints, particularly in inland waterways and port access corridors

- High port charges and demurrage fees, reducing Ghana’s attractiveness relative to regional competitors

- Congestion at Tema and Takoradi ports, leading to vessel delays and higher logistics costs

- Safety concerns, especially on Lake Volta, due to inadequate enforcement and poor safety equipment

- High marine fuel and freight costs, which impact shipping lines and domestic operators

- Inefficiencies in customs clearance, often compounded by bureaucratic procedures and allegations of corruption

- Shortage of skilled professionals, including marine engineers, logistics managers, and port operations specialists

- Environmental compliance costs, which add to already high operational expenses

- Competition from road transport, particularly for inland cargo movement

Competitive Landscape and Key Players

Ghana’s water transport industry features a diverse mix of state-owned enterprises, multinational shipping lines, and local logistics firms. The market includes subsidiaries of major global players such as Maersk MSC Ghana, CMA CGM, Hapag-Lloyd Ghana, and PIL Ghana, alongside strong local operators.

Notable industry participants include BluChip Logistics, Inchcape Shipping Services Ghana, Sharaf Shipping Agency, Supermaritime Ghana, and Hull Blyth Ghana. State institutions such as the Ghana Maritime Authority and Ghana Shippers Authority play regulatory and advocacy roles, while the Volta Lake Transport Company remains pivotal to inland water transport.

In total, the industry features more than two dozen prominent companies across shipping, agency services, freight forwarding, and inland transport, reflecting a competitive but fragmented market structure.

Opportunities for Growth and Investment

Several developments present significant opportunities across Ghana’s maritime and inland water transport value chain:

- Proposed Keta Port Development: The planned construction of a new port in the Volta Region has the potential to transform regional trade, create new logistics corridors, and stimulate investment across shipping, warehousing, and industrial services.

- Ship Repair and Marine Services: The construction of a floating dock at Takoradi opens new opportunities in ship repair, maintenance, and auxiliary marine services.

- Oil and Gas Logistics: Takoradi Port’s role as an offshore oil and gas supply hub continues to expand, driving demand for specialised maritime services.

- Technology and Smart Ports: Port expansion projects create demand for digital solutions, automation, IoT sensors, and cargo management systems.

- Sustainable and Green Shipping: Renewable energy projects and green port initiatives offer opportunities for suppliers of clean technologies and environmental solutions.

- AfCFTA Implementation: Hosting the African Continental Free Trade Area Secretariat positions Ghana as a focal point for intra-African trade growth.

- 24-Hour Port Operations: Continuous operations at Tema and Takoradi are expected to improve efficiency, reduce congestion, and boost cargo throughput.

Industry Trends

Key trends shaping the sector include:

- Rising regional competition from West African ports with advanced infrastructure

- Ongoing expansion and modernisation of Tema and Takoradi ports

- Increased adoption of digital platforms and smart port technologies

- Growth in local and transit cargo volumes

- Greater reliance on public-private partnerships in port development

- Expansion of inland water transport on Lake Volta

- Integration of inland transport with road and rail networks

- Emphasis on reducing environmental impact and improving sustainability

The Volta Lake Ghana Transport Company is actively pursuing fleet modernisation and service integration strategies to enhance capacity and competitiveness.

Looking ahead, Ghana’s sea, coastal, and inland water transport industry is poised for growth, provided structural challenges are addressed. Continued investment in logistics infrastructure, regulatory reform, workforce development, and technology adoption will be critical to unlocking the sector’s full potential.

The completion of ongoing port expansion projects, the proposed Keta Port, and improved inland connectivity are expected to support higher trade volumes and strengthen position as a regional maritime hub. However, intensifying regional competition and rising operational costs underscore the need for sustained policy coordination and private-sector engagement.

With the right Ghana mix of investment, governance reform, and innovation, Ghana has the opportunity to compete more effectively in the global shipping industry and fully leverage its strategic maritime advantages.

Source link: https://www.businesswire.com