Worldwide Largest 550 Cellular IoT Projects Database 2025 Reveals Scale, Growth, and Industry Transformation

The WorldwideLargest 550 Cellular IoT Projects Database 2025 represents one of the most comprehensive and authoritative resources available for understanding the global cellular Internet of Things (IoT) landscape. Developed as part of an ongoing, world-class IoT market research program, the database provides unparalleled visibility into the largest active cellular IoT deployments across industries, regions, and technology segments.

Designed to support a broad range of stakeholders—including telecom operators, IoT platform providers, hardware manufacturers, investors, consultants, system integrators, and government agencies—the database delivers detailed, actionable intelligence on where large-scale cellular IoT adoption is occurring today and how it is expected to evolve over the next five years.

Now in its ninth edition, the database reflects the rapid maturation of cellular IoT from a niche technology into a foundational layer of digital infrastructure supporting transportation systems, automotive platforms, utilities, industrial operations, smart cities, healthcare, and consumer applications worldwide.

A Definitive View of Large-Scale Cellular IoT Deployments

The 2025 edition identifies and analyzes the 550 largest cellular IoT projects globally, capturing deployments that collectively account for an estimated 743.2 million active cellular IoT connections by the end of 2024. This figure alone represents approximately 19.6 percent of all cellular IoT connections worldwide, underscoring the dominance of large-scale, enterprise-grade projects in shaping overall market dynamics.

More than 120 deployments within the database have already surpassed the one-million-unit threshold, highlighting the degree to which cellular IoT has scaled beyond pilot programs into full commercial and operational rollouts. At the very top of the market, the ten largest deployments alone exceed 230 million connected units, demonstrating the concentration of scale among a small number of global leaders.

Each project included in the database is evaluated not only on its current size, but also on its geographical footprint, industry vertical, and projected growth trajectory over a five-year forecast period extending through 2029.

Broad Coverage Across Industry Verticals

One of the defining strengths of the database is its cross-vertical scope, reflecting how cellular IoT has become embedded across nearly every major sector of the global economy. The projects span a wide range of application categories, including:

- OEM automotive

- Aftermarket automotive

- Transport and logistics

- Utilities

- Infrastructure and smart cities

- Buildings and security

- Retail

- Industrial and manufacturing

- Consumer electronics

- Healthcare

- Other specialized verticals

In terms of project count, transport and logistics emerges as the largest vertical represented within the top-550 list. This reflects the widespread adoption of cellular IoT for fleet management, asset tracking, cold-chain monitoring, telematics, and logistics optimization across global supply chains.

Following transport and logistics, utilities rank as the second-largest vertical by number of projects, driven by smart metering, grid monitoring, and infrastructure modernization initiatives. OEM automotive, retail, aftermarket automotive, buildings and security, industrial, and healthcare sectors also feature prominently, demonstrating the broad-based relevance of cellular connectivity across both physical and digital systems.

Unit Scale Tells a Different Story

While transport and logistics leads in the number of projects, a different picture emerges when examining the number of active connected units represented by each vertical.

In terms of total active cellular IoT units, OEM automotive stands out as the largest vertical by a significant margin. By the end of 2024, OEM automotive projects account for approximately 281.3 million active connections, reflecting the rapid integration of cellular connectivity into vehicles for telematics, diagnostics, infotainment, over-the-air updates, and safety systems.

Utilities rank second in unit volume, with an estimated 152.3 million active connections, driven largely by large-scale smart electricity, gas, and water metering deployments. Transport and logistics, while leading in project count, account for approximately 140.1 million active units, reflecting a more fragmented but still substantial deployment landscape.

This contrast between project count and unit volume highlights important structural differences between verticals. Automotive deployments tend to be highly standardized and globally scaled, while transport and logistics projects are often more diverse, regionally segmented, and application-specific.

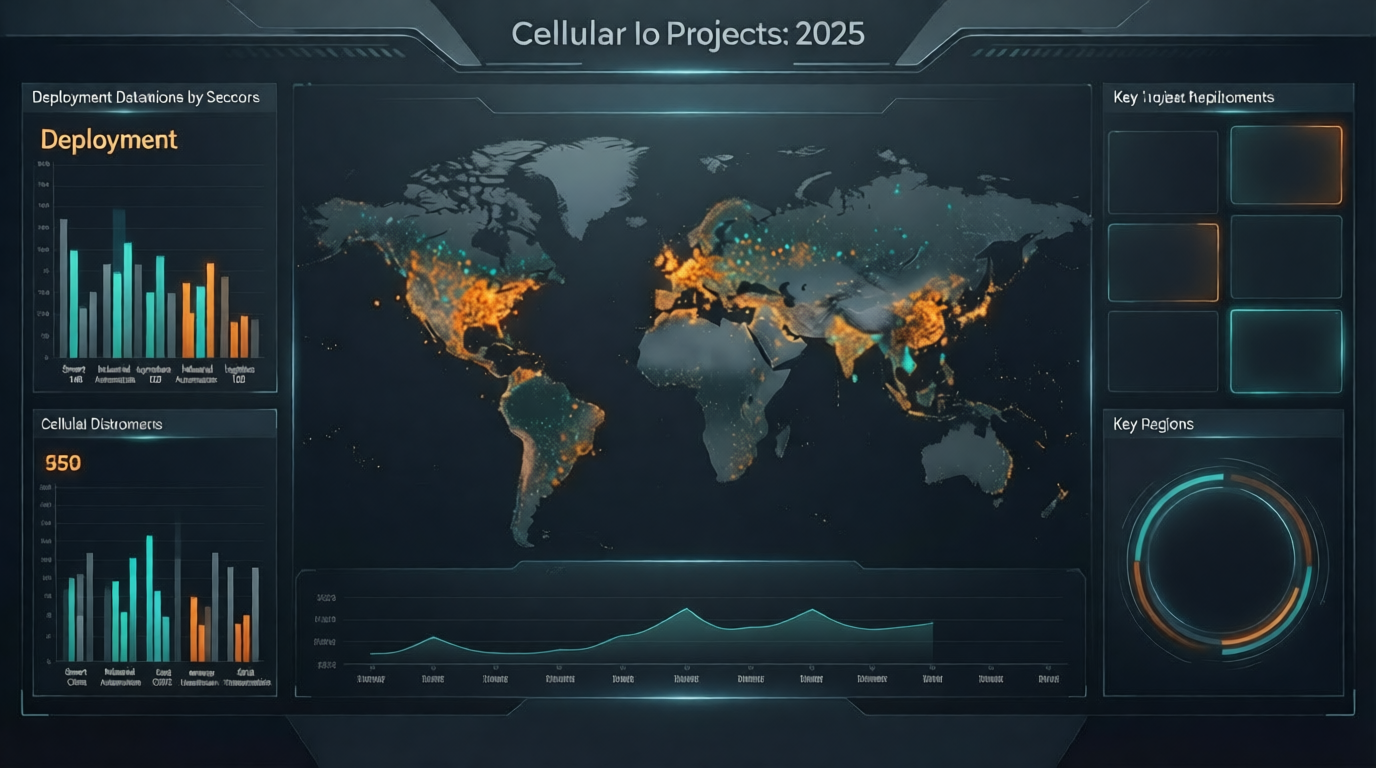

Geographic Distribution of Global IoT Deployments

From a regional perspective, the database provides detailed insight into where large-scale cellular IoT adoption is concentrated and how it is distributed across global markets.

- Europe accounts for approximately 178.8 million active cellular IoT units, reflecting strong adoption across automotive, utilities, and industrial sectors, supported by regulatory frameworks and early investments in connected infrastructure.

- North America represents around 162.2 million active units, driven by large automotive OEM programs, advanced logistics networks, and extensive utility modernization efforts.

- The Rest of World category—which includes Asia-Pacific, Latin America, the Middle East, and Africa—accounts for a combined 337.3 million active units, making it the largest regional segment overall.

The scale of deployments outside North America and Europe underscores the increasingly global nature of cellular IoT adoption. Emerging markets are not only catching up but, in many cases, leapfrogging traditional infrastructure models by deploying connected systems at scale from the outset.

Growth is expected to be driven by several structural factors, including:

- Continued penetration of cellular connectivity in new vehicle models

- Expansion of smart utility infrastructure in both developed and emerging markets

- Increasing demand for real-time visibility and automation in logistics and supply chains

- Adoption of cellular IoT in industrial digitization and predictive maintenance

- Ongoing improvements in cellular standards, including LTE-M, NB-IoT, and 5G

The database’s project-level forecasts allow stakeholders to identify not only which deployments are largest today, but also which are expected to deliver the strongest growth over the coming five years.

What the Database Delivers

The 550 Largest Cellular IoT Projects Worldwide Database is designed to function as both a strategic reference and a practical working tool. Delivered in Excel format, it includes detailed data for each deployment, such as:

- Project size and active connection counts

- Involved companies and ecosystem partners

- Headquarters location and company website

- Primary IoT vertical classification

- Regional and geographic breakdown of active connections

- Five-year forecasts through 2029

- Analyst commentary explaining methodology and key findings

This level of granularity enables users to benchmark their own deployments, assess competitive positioning, identify partnership opportunities, and evaluate investment risks and opportunities.

Key Questions Addressed by the Research

The database is structured to answer a wide range of critical strategic and operational questions, including:

- Which cellular IoT projects are currently the largest in the global market?

- How are major IoT deployments distributed geographically by region?

- Which projects are expected to experience the highest growth rates over the next five years?

- Which industry verticals are producing the greatest number of large-scale deployments?

- How will the composition of the top-550 list evolve as existing projects expand and new deployments emerge?

By addressing these questions at both an aggregate and project-specific level, the database supports informed decision-making across the IoT value chain.

Structure and Analytical Framework

The report is organized to guide users from high-level insights to detailed analysis, including:

- Introduction and scope definition

- Methodology and project selection criteria

- Summary of key findings

- Analysis of deployments by vertical market

- Forecast analysis of future vertical developments

- Regional and geographic market analysis

- Concluding remarks and future outlook

- Comprehensive list of key figures and data tables

Additional analytical views include:

- Overview of deployments by IoT vertical (2024)

- Active IoT units by vertical (2024–2029)

- Active IoT units by vertical and geographical market (2024)

A Strategic Resource for a Connected Future

As cellular IoT continues to underpin the digital transformation of industries worldwide, understanding where scale exists—and where it is heading—has never been more critical. The Worldwide Largest 550 Cellular IoT Projects Database 2025 provides a definitive, data-driven foundation for navigating this rapidly evolving market.

By combining depth, scale, and forward-looking analysis, the database offers a clear window into the projects shaping the future of connected systems across automotive, transport, utilities, infrastructure, and industrial markets worldwide.

Source link: https://www.businesswire.com