Joby Aviation Prices $513.9 Million Underwritten Offering to Accelerate Commercial Air Taxi Development

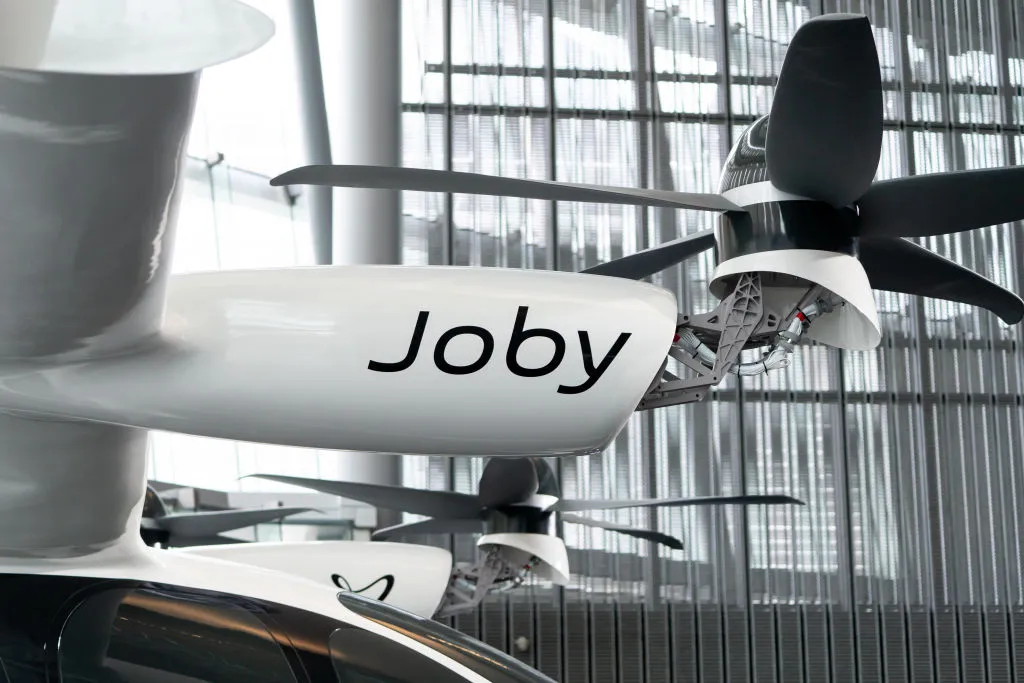

Joby Aviation, a pioneering force in the emerging electric air taxi market, has announced the pricing of its previously disclosed underwritten public offering of common stock. The offering represents a major step forward in Joby’s long-term strategy to fund certification, manufacturing, and commercial launch efforts for its revolutionary all-electric vertical takeoff and landing (eVTOL) aircraft designed for urban air mobility.

Under the terms of the offering, Joby will issue and sell 30.5 million shares of its common stock at a public offering price of $16.85 per share, generating gross proceeds of approximately $513.9 million. In addition, the company has granted the underwriter—Morgan Stanley & Co. LLC—a 30-day option to purchase up to an additional 4,575,000 shares to cover any over-allotments. The offering is expected to close on October 9, 2025, pending the satisfaction of customary closing conditions.

Strategic Use of Proceeds

Joby intends to deploy the net proceeds from this offering, together with its current cash, cash equivalents, and short-term investments, to fund several key initiatives critical to the company’s near-term and long-term success. These include:

- Aircraft Certification: Supporting the ongoing Federal Aviation Administration (FAA) type certification process for Joby’s all-electric air taxi. Certification is a pivotal milestone required before the company can commence passenger operations in the United States and internationally.

- Manufacturing Expansion: Accelerating production readiness by investing in advanced manufacturing capabilities, automation, and supply chain scaling. Joby has been building a vertically integrated production system to ensure high-quality output and control over core technologies such as batteries and propulsion systems.

- Commercial Service Preparation: Laying the groundwork for the planned commercial launch of its aerial ridesharing service. This includes developing operational infrastructure, training pilots and maintenance crews, and enhancing flight control systems.

- General Corporate Purposes: Maintaining liquidity for working capital, research and development, and other strategic initiatives aimed at strengthening the company’s market leadership position in the eVTOL sector.

Morgan Stanley as Lead Underwriter

Morgan Stanley will serve as the book-running manager for the offering, leveraging its deep expertise in aviation, mobility, and high-growth technology financing. The investment bank has played a central role in numerous high-profile equity offerings within the clean energy and next-generation transportation industries.

This partnership reinforces investor confidence in Joby’s long-term vision and operational execution as the company continues to attract substantial institutional interest in the fast-evolving advanced air mobility (AAM) sector.

Regulatory Filings and Offering Details

Joby’s underwritten offering is being made pursuant to a registration statement on Form S-3, filed with the U.S. Securities and Exchange Commission (SEC) on October 24, 2024, which became automatically effective upon filing. The offering will be conducted solely through a prospectus and a related prospectus supplement, ensuring full transparency and regulatory compliance.

Prospective investors may access the final prospectus supplement and accompanying prospectus free of charge through the SEC’s EDGAR database at www.sec.gov once available. Alternatively, these documents can be requested directly from Morgan Stanley & Co. LLC by contacting its Prospectus Department, located at 180 Varick Street, 2nd Floor, New York, NY 10014.

As standard practice, Joby emphasized that this press release does not constitute an offer to sell or a solicitation of an offer to buy securities, and no sale of the securities will occur in jurisdictions where such activity would be considered unlawful prior to proper registration or qualification.

A Step Toward Commercial Readiness

The capital raised through this offering is expected to play a vital role in propelling Joby toward its ultimate goal—launching commercial air taxi services that provide safe, quiet, and emissions-free urban transportation. The company has made significant progress in recent months, including:

- Flight Testing Milestones: Joby has conducted extensive flight testing, both in the United States and abroad, demonstrating the performance and reliability of its eVTOL aircraft. These flights are critical for certification validation and operational readiness.

- Partnerships and Demonstrations: The company recently showcased its aircraft at major aviation events, such as the California International Airshow and collaborative demonstration flights in Osaka, Japan, with its strategic partner ANA Holdings. These initiatives highlight Joby’s commitment to establishing a global footprint in urban air mobility.

- Manufacturing Expansion: Joby’s pilot production line in Marina, California, continues to scale operations. The company is investing in automated production technologies and supply chain optimization to ensure efficiency and scalability once certification is achieved.

Market Context and Industry Outlook

Joby’s announcement comes amid growing investor enthusiasm for the electric aviation and advanced air mobility markets. Analysts project that the global eVTOL industry could exceed $100 billion in value by 2035, driven by urban congestion, environmental regulations, and the demand for faster intra-city transport options.

As one of the leading contenders in this space, Joby has built a comprehensive ecosystem that spans aircraft design, manufacturing, software integration, flight operations, and regulatory engagement. The company’s proprietary technology—ranging from high-energy-density battery systems to advanced flight control algorithms—positions it as a front-runner in defining the next era of personal and commercial air transport.

By securing additional capital through this offering, Joby aims to ensure it maintains a strong balance sheet as it transitions from the development phase into commercial operations. The funds will help sustain momentum in critical certification and production efforts while providing flexibility to seize emerging strategic opportunities, partnerships, and international expansion possibilities.

Leadership Perspective

While Joby did not issue a separate management statement in this release, CEO JoeBen Bevirt has consistently emphasized that strategic funding rounds like this one are essential for realizing the company’s mission. In prior communications, Bevirt has underscored the company’s focus on safety, sustainability, and scalability—key attributes necessary for mainstream adoption of electric air taxis.

Bevirt has also highlighted that Joby’s vertically integrated approach, from propulsion technology to pilot training, enables the company to manage both cost and quality control while accelerating readiness for commercial service.

With this $513.9 million offering, Joby Aviation strengthens its financial foundation at a pivotal juncture in its development. As the company continues toward FAA certification and eventual commercial launch, the infusion of capital will help ensure that it can execute its roadmap efficiently, maintain technological leadership, and expand its operational infrastructure.

Investors and industry observers alike will be watching closely as Joby enters the next phase of its journey—turning the promise of electric air taxis into a transformative reality for global urban transportation.

This announcement does not constitute an offer to sell or a solicitation to buy securities in any jurisdiction where such actions would be unlawful. The sale of shares under the offering will occur only under proper registration and qualification procedures as required by applicable securities laws.